More construction companies than ever have to rely on two or more incomes. We have met with contractors from several groups:

Group One - One person works for an outside employer, and the other person is self-employed. Today it is more common to see both partners are self-employed and own their business.

Businesses Owned By - Related business partners and business types may be merged into a single QuickBooks file, and that can cause all kinds of trouble!

When The Individual Household Partners - file their annual tax return jointly, the tax preparer who files the annual Income Tax Return looks at all the business and personal financials and is the final authority on what can and cannot be merged into a single tax return.

Most Tax Returns Are About A "Zillion" - Pages long with much of the information duplicated on both the personal and business returns, which is why we recommend you hire someone who specializes in preparing annual tax returns, NOT A Jack-Of-All-Accounting-Trades-Master-Of-None. We do not prepare annual tax returns; we do process Payroll and prepare Quarterly Tax Reports.

Why Do You Need Individual QuickBooks Company Files?

Even With Related Personal Partnerships - (married couples), each business type is not related and requires its own Federal Tax ID Number (EIN). This creates the need for two or more QuickBooks files.

For Example -One partner is a Construction Contractor, and the other partner has an Event's Planning business.

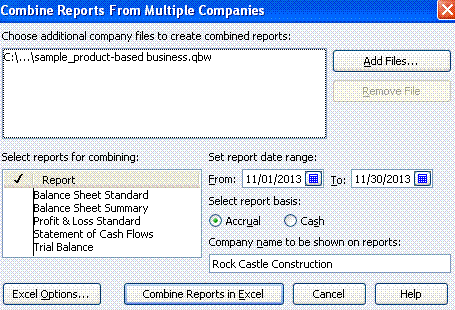

Multiple Companies In QuickBooks: QuickBooks will support multiple company files. If one partner uses a Mac Computer and the other partner uses a PC, you can access QuickBooks windows version using our QuickBooks in the Cloud.

Individual Ownership - Of each company is not by the same parties.

Company Ownership Issues - Business partnerships between unrelated people makes the day to day accounting even more complicated. Who handles the bookkeeping can range from "Everyone" to write checks, and "No One" is doing the actual bookkeeping. This leads to a situation known as QuickBooks Out Of Control!

Common Practice - Money is coming/going between accounts of non-related companies, and expenses are paid by multiple accounts, either business / personal / or by others except the business checking account of the actual company.

When Company Funds Are Used - There is a need to track the flow of funds to/from each of the company QuickBooks files. Our focus is Contractors – we also focus on the business finances of our clients. Where did the money come from (Income / Personal funds / Money from others) – and where did it go? (Expenses / COGS / Taxes / Personal Draw) For this reason, when the second/third / more company is "non-medical," we recommend that we handle the bookkeeping for all of the company files.

Common Practice - Money is coming/going between personal accounts to pay business expenses by family members or non-related household members.

For example, the contractor uses a personal credit card and shows the QuickBooks file's expense. Yes, they should have used a company credit card; however, you were at the store, you needed some material to finish the job, and did not have the company credit card with you, or it may have been maxed out. So you did what you needed to do to get the job done!

Example - Girlfriend or Boyfriend pays from their personal account for expenses like vehicle insurance/bond/contractor's license / etc. – because it was the fastest way to get it done. Someday she/he would like to be paid back.

How Do You Track All Of It - We have a Bookkeeping System to account for all business expenses. Without properly reflecting all the business expenses – The profit & Loss Statement is incorrect and equals higher taxes.

If The Business Owner Takes Money Out - Under the theme of "It's Mine" without proper documentation, the Profit & Loss is incorrect.

Sometimes Clients Want - To keep doing the QuickBooks file for "Their Tiny Little Company," and as time goes on, they forget that the funds were handled on one side and missing on the other.

As Construction Bookkeepers - We know what standard and usual types of expenses are. If we see expenses have been paid with personal funds/funds by others – we track it in QuickBooks. If we see that regular expenses are missing – we ask about them. Maybe those expenses don't exist. Most contractors want to have an idea of the individual profit by job and various other reports.

We can always help you a little or a lot, depending on your construction business needs. Don't hesitate to reach out.

About The Author:

![]() Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 1-800-361-1770 or email sharie@fasteasyaccounting.com.

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 1-800-361-1770 or email sharie@fasteasyaccounting.com.